vat rate on sand jelly under karnataka vat 2003

2021-07-14T14:07:14+00:00

1[FIRST SCHEDULE (Goods exempted from tax under sub

3 All processed fruit and vegetables including fruit jams, jelly, pickle, fruit squash, paste, fruit drink and fruit juice (whether in sealed container or otherwise) 4 All types of yarn other than cotton and silk yarn in hank; sewing thread 5 1[All utensils 2[xxx]2including pressure cookers and pans and COMMODITY WISE RATE OF TAX UNDER VAT ACT (updated till 02052015) Sl No Name of commodity / commodities Current Tax Rate (%) Schedule No 1 Account Books 5 C 2 Adhesives 5 C 3 Adhesive tapes made of plastic 5 C 4 Other Adhesive tapes 145 CA 5 Adhesive plaster 145 CA 6 Additives, concentrates and supplements of poultry feed 0 A 30 COMMODITY WISE RATE OF TAX UNDER VAT ACT NOTIFICATION UNDER VAT/KST ACT FROM 01032005 TO 31032006 Sl No Karnataka Value Added Tax Act, 2003 (Karnataka Act 32 of 2004), the Government of Karnataka, hereby appoints the first day of April, 2005, as the date on which Sections 3 INDEX NOTIFICATION UNDER VAT/KST ACT FROM 0103

SCHEDULES UNDER THE WEST BENGAL VALUE ADDED

SCHEDULES UNDER THE WEST BENGAL VALUE ADDED TAX ACT, 2003 (AS ON 01042013) SCHEDULE A [See section 21] Goods on sale of which no tax is payable Serial No Description of goods Conditi ons and Excepti ons (1) (2) (3) 1 Agricultural implements manually operated or animal driven 2 Aids and implements 1A [used by handicapped persons including Preowned cars under this entry means an used car registered under the provisions of the Motor Vehicles Act, 1988 (Central Act 59 of 1988) and purchased by a dealer for resale Explanation 2— For the purpose of this entry, the amount of tax as specified in column (3) is payable on per car basis in lieu of the paise in the rupeeDept of Sales Tax Know the GST rate for cement, TMT Steel, Bricks/ Block, Sand and all other building construction materials Goods and service tax system was implemented in July 1st across India to replace indirect taxes levied by Central state governmentGST rates for building materials Construction

Karnataka VAT Check VAT Rate, Registration, efiling

The Karnataka VAT Act was implemented in 2003 and contains all the contract and if the description of said works contract is not covered under any category then it will be liable to a VAT rate of 145% Karnataka VAT Registration Every dealer who engages in trade of products and services that come under the ambit of VAT must register What is rate of Tax applicable for Sand under Karnataka vat act Reply January 24, 2014 at 9:06 am my id is : [ protected] Reply January 11, 2013 at 2:44 pm padma says: hi what is the vat on sand jelly Reply February 14, 2012 at 4:39 pm what is the rate of tax (Karnataka vat)on banner printing, please send to my mail id Karnataka VAT rate changes wef 01042010Tax reduction from 145% to 55% on Wick stoves, Mobile phone charger, Msand, Msand manufacturing machinery/ equipment, Industrial cables namely XLPE Cables, Jelly Filled Cable, Optical Fibre Cable and PVC Cable,PreSensitized Lithographic Plates used in printing industry, Packing materials like Pallets, Box Pallets and other Load Boards Karnataka Budget 2015 saralvat

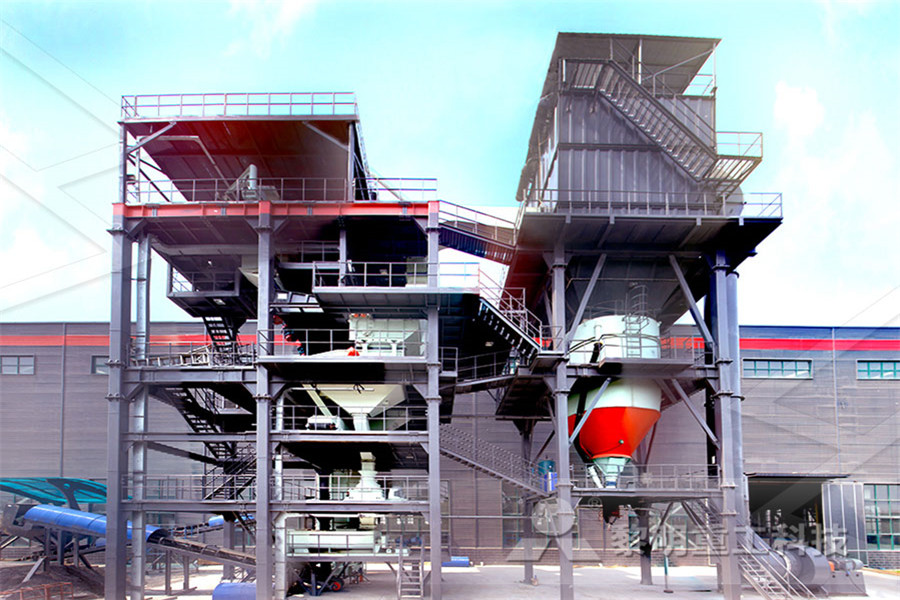

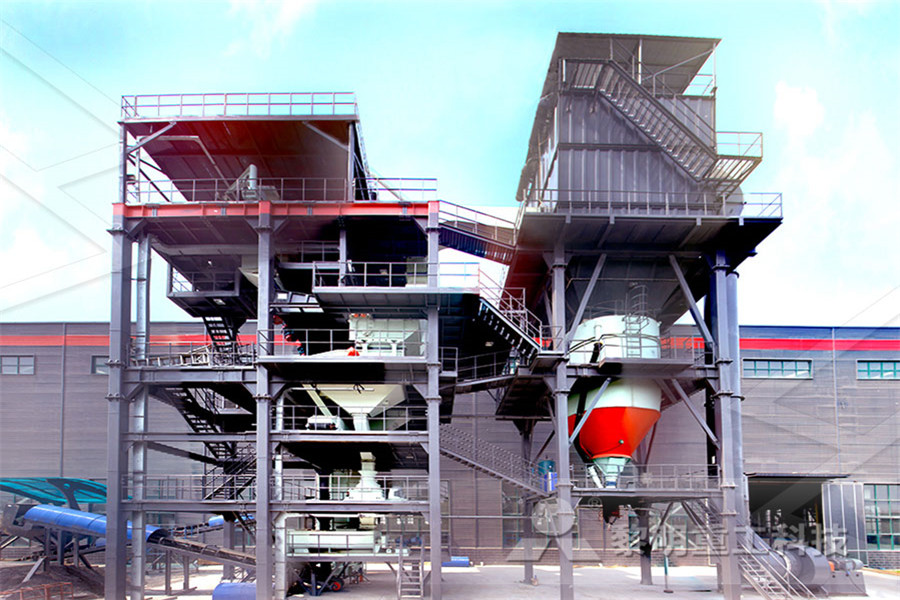

vat tax rate on crusher in « Mining

stone crusher in vat karnataka – Grinding Mill China 25 Apr 2013 rate vat tax on stone crusher in haryana depreciation rate of stone crushing plant; vat on sand in karnataka; todays gold rate in kerala 24 »More detailed vat rate on sand jelly under karnataka vat 2003 chinagrindingmill vat rate on sand jelly under karnataka vat 2003 The Gulin product line, consisting of more than 30 machines, sets the standard for our industry We plan to help you meet your needs with our equipment, with our Inquire Now; Karnataka budget: Liquor, cigarettes, fuel to be dearercagewoodworkingquestions 🙆How To Buildvat rate on sand jelly under karnataka vat 2003 chinagrindingmill vat rate on sand jelly under karnataka vat 2003 The Gulin product line, consisting of more than 30 machines, sets the standard for our industry We plan to help you meet your needs with our equipment, with our Inquire Now; Karnataka budget: Liquor, cigarettes, fuel to be dearerplans12x14shed 😓King'S Fine Woodworking Inc

build 8x8 shed plans 🏽🏫DIY Pete

vat rate on sand jelly under karnataka vat 2003 chinagrindingmill vat rate on sand jelly under karnataka vat 2003 The Gulin product line, consisting of more than 30 machines, sets the standard for our industry We plan to help you meet your needs with our equipment, with our Inquire Now; Karnataka budget: Liquor, cigarettes, fuel to be dearerCCT Clarification NoCLR/CR141/1415, dated 28032016 Clarification u/s59(4) of VAT Act, 2003 regarding rate of tax applicable on ''Roofing Tiles made of earthern elements such as Mud and Clay'' Commercial Taxes Department ctaxkarnic COMMODITY WISE RATE OF TAX UNDER VAT ACT (updated till 02052015) Sl No Name of commodity / commodities Current Tax Rate (%) Schedule No 1 Account Books 5 C 2 Adhesives 5 C 3 Adhesive tapes made of plastic 5 C 4 Other Adhesive tapes 145 CA 5 Adhesive plaster 145 CA 6 Additives, concentrates and supplements of poultry feed 0 A 30 COMMODITY WISE RATE OF TAX UNDER VAT ACT

Dept of Sales Tax

Preowned cars under this entry means an used car registered under the provisions of the Motor Vehicles Act, 1988 (Central Act 59 of 1988) and purchased by a dealer for resale Explanation 2— For the purpose of this entry, the amount of tax as specified in column (3) is payable on per car basis in lieu of the paise in the rupee Particulars: Rate up to 31 March, 2010: Rate with effect from 1 April, 2010: Rate of tax on goods falling under Schedule III, other than the declared goods, as specified under Section 14 of the Central Sales Tax Act, 1956 which will continue to be liable to tax at 4%Karnataka VAT rate changes wef 01042010Tax reduction from 145% to 55% on Wick stoves, Mobile phone charger, Msand, Msand manufacturing machinery/ equipment, Industrial cables namely XLPE Cables, Jelly Filled Cable, Optical Fibre Cable and PVC Cable,PreSensitized Lithographic Plates used in printing industry, Packing materials like Pallets, Box Pallets and other Load Boards Karnataka Budget 2015 saralvat

Karnataka Value Added Tax Notification No:DPAL 35

An Ordinance further to amend the Karnataka Value Added Tax Act, 2003 Whereas the Karnataka Legislative Council is not in session and the Governor of Karnataka is satisfied that the circumstances exist which render it necessary for him to take immediate action further to amend the Karnataka Value Added Tax Act, 2003 (Karnataka Act 32 of 2004 The FAA passed order under bearing Nos VAT AP 190 to 201/0809 in respect of assessment period April 2006 to March 2007, and disposed of these appeals on 1482008 All these cases have been filed under Section 63 of Karnataka Value Added Tax Act, 2003 (for short, the 'KVAT Act, 2003') 2 Brief facts of these appeals are as under:TR Rajan v State Of Karnataka Karnataka High Court Particulars: Rate up to 31 March, 2010: Rate with effect from 1 April, 2010: Rate of tax on goods falling under Schedule III, other than the declared goods, as specified under Section 14 of the Central Sales Tax Act, 1956 which will continue to be liable to tax at 4%Karnataka VAT rate changes wef 01042010

Karnataka Value Added Tax Notification No:DPAL 35

An Ordinance further to amend the Karnataka Value Added Tax Act, 2003 Whereas the Karnataka Legislative Council is not in session and the Governor of Karnataka is satisfied that the circumstances exist which render it necessary for him to take immediate action further to amend the Karnataka Value Added Tax Act, 2003 (Karnataka Act 32 of 2004 Karnataka Sales tax Ordinance 2003 Tax rates in respect of the following commodities have been revised as indicated wef 1/6/2003I) By amendment to relevant entries in the Second Schedule: Sl Commodity: Revised: No rate: 1: Adhesives New Page 1 [sandb]vat rate on sand jelly under karnataka vat 2003 chinagrindingmill vat rate on sand jelly under karnataka vat 2003 The Gulin product line, consisting of more than 30 machines, sets the standard for our industry We plan to help you meet your needs with our equipment, with our Inquire Now; Karnataka budget: Liquor, cigarettes, fuel to be dearerbuild 8x8 shed plans 🏽🏫DIY Pete

TR Rajan v State Of Karnataka Karnataka High Court

The FAA passed order under bearing Nos VAT AP 190 to 201/0809 in respect of assessment period April 2006 to March 2007, and disposed of these appeals on 1482008 All these cases have been filed under Section 63 of Karnataka Value Added Tax Act, 2003 (for short, the 'KVAT Act, 2003') 2 Brief facts of these appeals are as under: taxable at 55% VAT: MSand manufacturing machinery Pallets, box pallets and other load boards; pallet collars Presensitized lithographic plate Industrial cables namely High voltage cable, XLPE cable; Jelly filled cable, Optical fibre cable and PVC cable VAT rate of 17% increased to 20% on Cigarettes, Cigars, Gutkha and other manufacturedPrakash Consultancy Service Management Reduce rate of VAT to 55% on Industrial Cables namely, High Voltage Cable, XLPE Cables, Jelly Filled Cable, Optical Fibre Cable and PVC Cable conceding the long pending request of Electrical Industry Hence request you to kindly explain us the following:1under which section or Karnataka State Budget 2015 Tax and Stamp Duty

How To Collected In Vat Stone Crusher In Karntaka

Is it crushers liability to vat Vat tax rate on crusher in mining jun 06 2013 tax on crusher metal stands at and tax on compounding revised based more detailed stone crusher in vat karnataka grinding mill china 25 apr 2013 rate vat tax on stone crusher in haryana depreciation rate Read More Tax reduction from 145% to 55% on Wick stoves, Mobile phone charger, Msand, Msand manufacturing machinery/ equipment, Industrial cables namely XLPE Cables, Jelly Filled Cable, Optical Fibre Cable and PVC Cable,94 Budget Highlights 201516 PreSensitized Lithographic Plates used in printing industry, Packing materials like Pallets, Box Pallets and other Load Boards, pallet collars TAX BY MANISH: karnataka budget HighlightsVineet Kothari, J The petitioner assessee, M/s JK Cement Works, Muddapur, Mudhol Taluk, Bagalkot District, Karnataka, has filed these Revision Petitions under Section 65 of the Karnataka Value Added Tax Act, 2003 (for short 'KVAT Act') raising a question of law for consideration by this Court, being aggrieved by the order passed by the learned Karnataka Appellate Tribunal, Bengaluru, on JK CEMENT WORKS Vs STATE OF KARNATAKA on 23

types of crushers use in quarry

asphalt distributor bitumen sprayer atlas

hammer mill for dolomite machine saller in india

perbaikan dolimite jaw crusher di indonesia

wood crusher wood crusher machine wood crushing machine price

multinational mining mpanies in ghana

dealer powerscreen dublin

mobile ne crusher finlay

Organizational chart For Quarry

used heavy duty trommel screen australia

iron ore mining equipment in sweden crusher for sale

export stone crusher machine from china

challenges of minerals and mining act of ghana

clay brick crusher used rock crusher small rock hammer

grinder machine for home price in hyderabad

gold metal shaking revery table

pulverised al firing including crushers and puleri

About Vertical Roller Mill In Cement Plant

price in pulveriser machine

small horizontal hand mill for sale

crusher crusher plant spares in china

grinding tools bangalore

Hydraulic Mining Hose R1At

Widely Used mining Jaw Crusher With Quality Certification

granite quarry sh karimnagar andhra pradesh

of crushers used in the cement industry

labelled diagram of a grinding machine

sanbao jaw crusher specification

pyrophyllite sand washer for sale

shop for grinding curry powder